There are about 26.56 million businesses that rely on QuickBooks to keep their finances organized, and that may work okay for them for a while. Except, when they start looking for ways to improve efficiency, increase visibility, and scale business to keep up with trends and competition, they’ll need much more robust financial planning software. Something like the Sage Intacct Budgeting and Planning module.

Successful businesses are built upon planning, and with planning must always come finance. However, without a proper financial planning tool, it’s like driving in first gear for the rest of your life. It might be okay for short relaxing trips when you’re looking to cruise and soak in the scenery, but if you’re hoping to accelerate up a hill or pass other drivers on the road, first gear won’t cut it.

Let’s look at how Sage Intacct’s powerful & flexible Budgeting and Planning module is like driving a sleek six-speed manual transmission that helps you plan and grow a successful business. (Can you tell our marketing person likes cars? She still insists on driving a manual!)

Who Doesn’t Want to Save Millions?

A powerful cloud ERP solution drives significant savings in accounting and audit costs, while also eliminating painful spreadsheet-based budgeting. Then, you can level up even more, improving finance efficiency and saving additional money by combining your Sage Intacct ERP with Sage Intacct Budgeting and Planning. Finally, something that can put an end to those Excel nightmares that keep you up till the wee hours of the morning!

One family office and institutional investment firm, Halstatt, saves $1 million a year in accounting costs using Sage Intacct Budgeting and Planning. Since implementing the financial planning software module, they doubled their assets under management, increased financial efficiency by 60%, and reduced reporting time from over an hour to only minutes. All of this in combination with eliminating painful spreadsheet-based budgeting has been a complete game-changer for them and allows them to act on investment opportunities much faster. Each of these things can seem small when we list them in text but combined it adds up to over $1,000,000 in savings.

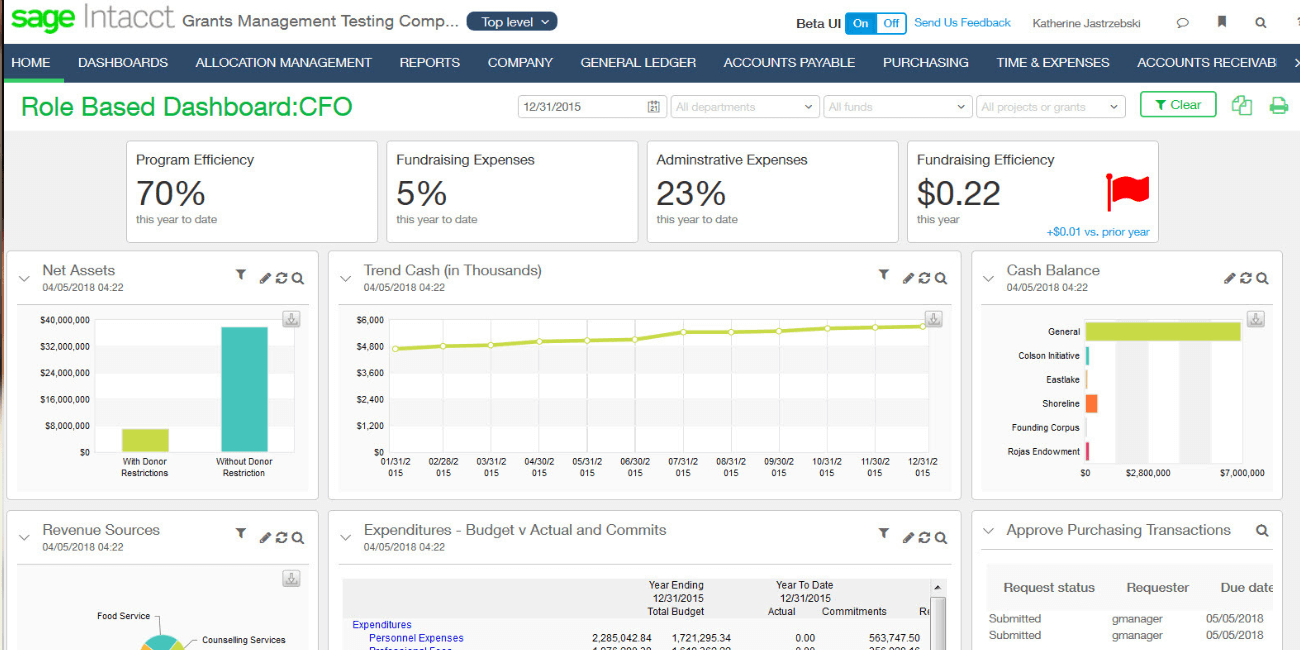

Amanda Goebel, a senior accountant at Halstatt states, “For the visibility, the Board enjoys Sage Intacct because if they have a question, we can get an answer to them right away. It’s no lag or saying, “Hey we need to run all these different reports.” And if we really wanted to, we could get the Board in there and they could see our dashboards. So, it’s something that is super easy to use and user-friendly.”

Mo’ Growth, Mo’ Data

With growth comes more data. More data increases time spent in data management, but with Sage Intacct’s Budgeting and Planning module, businesses save themselves 85% in budgeting and planning time while also maintaining timely access to the critical data they need for on-the-fly decisions.

To stay on top of all your financial data you need an all-in-one accounting solution that seamlessly integrates with other software programs. This way, you can pull all your important data into one centralized system for quick and cohesive analysis across the organization. This means less emailing back and forth excessive spreadsheets, broken formulas that suck up time, and unintentional calculation errors that sometimes lead to skewed or incorrect data that your team uses for critical decisions.

Additionally, with owning more data, you should also be thinking about increased security. 43% of cyber-attacks are made against small businesses, and this number has seriously increased, as it was a mere 18% just a few years ago. That means we can expect this number to increase even more in the years to come. So, how can you protect your data? How can you have effective data protection while also offering increased data accessibility? It’s a tight balancing act, but one that’s made possible with Sage Intacct Budgeting and Planning’s airtight encryption, controls, and comprehensive disaster recovery.

Planning That Goes Above & Beyond

Going back to our car analogy from before, what’s a road trip without a GPS? A back road trip (we can feel the eye rolls from here). A strategic plan requires thoughtful and careful planning if you want the best chance at achieving your business goals. Mapping out your route and its timeline, identifying short and long-term objectives (aka locations), as well as identifying potential roadblocks and detour options are all a part of planning a fun, stress-free road trip…or business plan. Just like GPS does this for you on the road, Sage Intacct’s financial planning software module also does this having scenario planning take 50% less time.

With all your financial information centralized in Sage Intacct, your customized reports, dashboards, modern forecasting capabilities, and what-if scenario modeling allow you to compare your current situation with your future business plans and goals to see if they’re actually attainable. These easy-to-use automation tools allow staff to execute hard-to-plan critical activities and make more informed decisions using actionable insights. With increased visibility and better tools, you can transform your finance team from number crunchers into strategic advisors.

Here is an example of effortless business modeling using Sage Intacct Budgeting & Planning:

This allows you to make quick financial decisions in hours, rather than days. Magaya, a leader in logistics software, reduced their budgeting and forecasting time by 50% and were easily able to account for high churn and reduced cash flow using the user-friendly Sage Intacct Budgeting and Planning module rather than Excel. We believe in helping businesses become the best that they can be and our accounting and budgeting experts would be happy to help you explore this great technology.

For more information on the Sage Intacct Budgeting & Planning module, check out this fun video demo below!