Quickbooks is a well-known, affordable and reliable choice for many companies and not surprisingly holds 80.88% of the market share with small businesses. We’ve worked with many accounting clients on Quickbooks and know it well. While it’s an excellent accounting software for small businesses, it’s important to be aware of the warning signs that indicate you’re outgrowing it. If you start experiencing growing pains, you may want to consider transitioning to a more robust accounting system that can better support your growing business needs.

The Warning Signs

As the saying goes, good things don’t last forever. You may start discovering that while the QuickBooks functionality was working great, you’re seeing some troubling signs, like:

- The system is continually crashing with payroll screens freezing, and/or experiencing delays.

- It’s taking too much time to view inventory and cost of sales reports as more and more inventory items and assemblies are added.

- You and your team are struggling with gathering insights to answer even the most basic business questions.

- Staff is showing an increasingly scary reliance on spreadsheets that often have hidden calculation and formula errors.

- Maybe it’s a combination of all of these!

So, what does this all mean? What’s happening, and what should you do? Should you be looking for alternatives to QuickBooks desktop software? We’re happy you asked.

Growing Pains Don’t Have to Be Part of Scaling

In a nutshell, these signs (and more), are growing pains. At some point or another, pain points like these will pop up when trying to expand operations, integrate with new more modern third-party applications, or manage more data volumes. QuickBooks can’t handle a growing business – it unavoidably slows everything down. When you’re familiar with what to look for, you can swiftly act as soon as these growing pains appear and before unexpected and expensive costs arise.

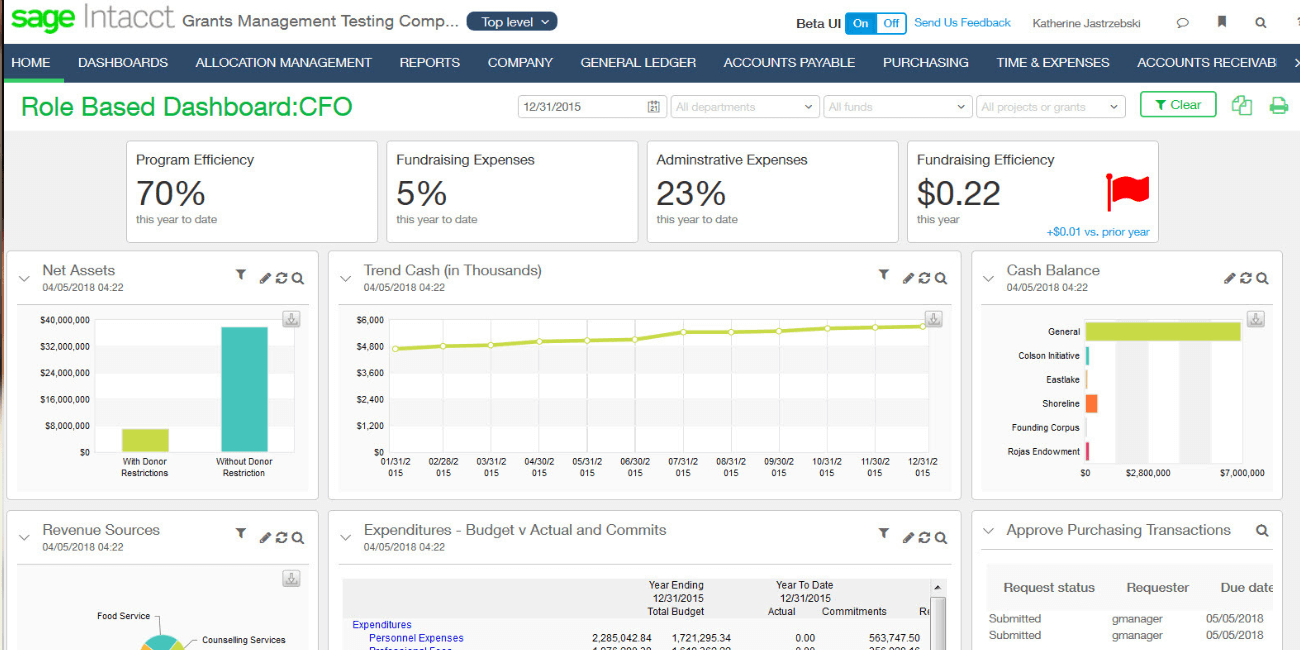

These warning signs prove you’re pushing or exceeding the limitations of your current accounting system and you need to graduate to a more sophisticated cloud-based financial software system. One that doesn’t obstruct growth and easily scales with you. Thankfully there are alternatives to QuickBooks desktop. Something called Sage Intacct.

Ease the Growing Pains

Don’t get us wrong, QuickBooks has a time and place, especially for a small just starting-out company. However, it’s not designed to provide professional financial management capabilities to growing organizations with complex, evolving demands that require higher visibility. Expanding into new markets and demographics requires an accounting system that can handle much more complex financial processes, like enhanced reporting, budgeting, and data management capabilities.

If you’re still thinking that it’s cheaper for you to stay with QuickBooks than upgrade to a new system, think again. Gartner research has found that the average amount of avoidable rework in accounting departments can take up to 30% of a full-time employee’s overall time which equals savings of 25,000 hours per year at a cost of $878,000 for an organization. This is time savings due to automation alone and easily covers the cost of most upgrades.

The Cost of Doing Nothing

Lack of Time & Accuracy

Let’s discuss the risks of not upgrading to a better accounting system. They include time and effort spent on fixing errors caused by manual processes and on repetitive tasks that should be automated. Automating your financial processes within a single centralized software system is much easier and more streamlined than spreadsheet overload where you’re emailing multiple versions back and forth. If you’ve ever seen something like, ‘budget_estimation_final_01-05-2023_v5.11.2-ow.xlsx’ arrive in your inbox then you know what I’m talking about.

Falling Behind Competitively

Virtually all (97%) enterprise IT decision-makers agree that process automation is vital to digital transformation. Pretty much all of us agree that in today’s technology-driven world if you’re not embracing intelligent automation tools, you are at risk of manual and inconsistent processes breaking and causing harm to your revenue and reputation. Something to remember is that automation fuels growth, with companies using automation growing revenue 220% faster than their counterparts. Basically, if you’re not integrating automation into your business, your business is falling behind.

Security Risks

Additionally, there are major risks to security when running on outgrown software. It’s a dog-eat-dog-world out there with so many malicious organizations and individuals just looking for a weak spot that they can exploit. When you have too much data and processes that your system can’t effectively safeguard or handle, you’re at risk of numerous vulnerabilities, like costly cyberattacks and the long-term impacts of data breaches. Depending on your industry, you may have stricter compliance requirements for storing of client data as you expand services, which Quickbooks may or may not meet.

Thankfully, these risks, plus the time and effort of managing a business on an accounting system you’ve outgrown can all be avoided if you keep a watchful eye on your business pulse.

Let’s end things on a positive note. If you’re reading this, you’re on the right track. Maybe you’ve related to some of the warning signs we mentioned above. If you have, don’t worry, because we have a solution. Our team of accounting and business advisor experts can build you a plan to transition away from QuickBooks and forward with Sage Intacct’s cloud-based accounting solution.

For more information on outgrowing QuickBooks and what your alternatives to QuickBooks desktop could be, read ‘The Hidden Costs of QuickBooks’ white paper.